COVID-19 Information & Updates

Updates

November 16, 2022

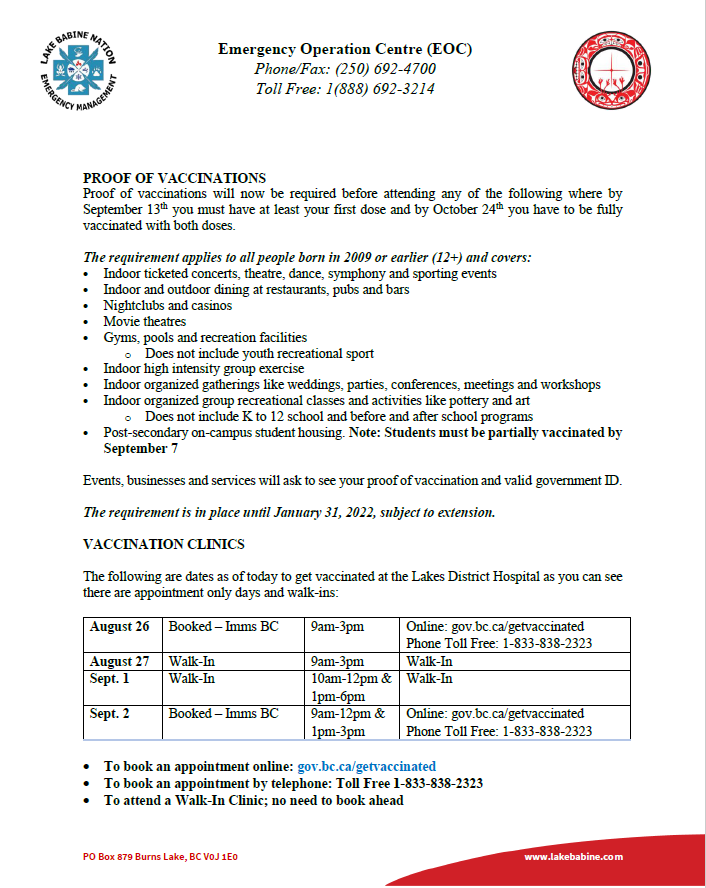

September 13, 2021

August 26, 2021 – Memo to LBN Members 2021 08 26 (Click here to download memo)

Children Ages 6-12 TikTok Entries:

1st Place: Marcus Adam – That’s my boy

@scarface0980 #myson #futureplayer #funny #nativetiktoks #fyp #2021 #holdup

2nd place: Layla Munger – My Sandwich (click here to view)

3rd place: Paige Adam – Split Face (click here to view)

Adult TikTok Entries:

1st Place: Desiree Loyie – Good Morning COVID (click here to view)

2nd Place: Darwin Adam -_They All Related (click here to view)

2nd Place: Uland Tom – Urban Potlatch (click here to view)

3rd Place: Felicia Alec – Breaking News Bingo

3rd Place – Desiree Loyie -_Close Blinds Visitors (click here to view)

3rd Place – Yvette Pierre – Duet Kid Rock (click to view)

May 7, 2021 Update

June 4, 2020 Update

Lake Babine Nation COVID-19 Bylaw

Lake Babine Nation COVID-19 Bylaw – click here to view

Funeral Protocol

Lake Babine Nation Funeral Protocol – click here to view

June 2, 2020 Letter to LBN Members

Lake Babine Nation Community Letter June 2 2020 – click here to view

First Nations Public Service Secretariat Webinar

First Nations Public Service Secretariat (FNPSS) hosted a webinar this morning and will do so at regular intervals hereafter. On the webinar today was: (1) Leah Wilson-George, Co-Chair First Nations Summit, and; (2) Bill Guerin, Associate Regional Director General ISC BC Region.

Here are some notes that I took for the time that I was able to listen in:

Bill Guerin/ISC: What is ISC doing?

- ISC is working collaboratively with FNHA/Emergency Mgt BC/First Nation Leadership Council et al to ensure access to ISC programs and services

- Administration issues:

- Reporting requirements have been temporary suspended and ISC BC Region is focusing on assisting FN communities. No funding to FNs will be stopped because of reports not being submitted

- No funding will be recovered if not all spent before fiscal year-end.

- FN with cash flow difficulties are to contact their FSO

- Concern: Band Offices scaling back staff/operations and some FN have concerns regarding laying off staff – this is not a directive from ISC. ISC is recommending ‘telework’ and working from home using technology.

- Reporting requirements have been temporary suspended and ISC BC Region is focusing on assisting FN communities. No funding to FNs will be stopped because of reports not being submitted

- Funding

- Allocation in two streams have already gone out to FN. In BC this is $7.2 Million for Emergency Mgt and $2.7 Million for Social Programs. Amendments have already gone out to all BC First Nations last week. Electronic signatures are accepted so that the process can be expedited so that Councils are not required to have in person meetings for the amendment(s).

- Emergency Mgt – and what this funding could be spent on include:

- Emergency Operations Centre costs

- Essential Services

- Social Programs – intent is to ‘mirror’ what the provincial Income Assistance programs are doing

- Social / Cultural Supports – whatever that is determined to be

- Buy food for Elders

- Hot Lunch Programs

- Questions on Social Programs at FN community level:

- There are additional people applying for Income Assistance – can these ‘new hires be reimbursed’?

- ISC has streamlined measures in place for IA application process (taking into consideration social distancing / health and safety of clients and staff)

- ISC recognizes that there will be ‘case load’ increases – nothing in place for new hires. Bill Guerin will see what can be used within ISC funding for this

- Can off-reserve members be assisted – ISC funding is targeted only for on-reserve program and service delivery. Off-reserve will have to access other resources i.e. Friendship Centre’s have federal emergency funding.

- There are additional people applying for Income Assistance – can these ‘new hires be reimbursed’?

- Questions on Social Programs at FN community level:

- The next allocation round of Emergency funding will be sent out via a simplified amendment process. Formulas are being worked on at ISC BC Region

- The Emergency Funding FN receive – can be carried forward beyond March 31/2020!

- Contact Band Social Development Program at ISC BC Region for clarifying questions anyone may have

- Emergency Mgt – and what this funding could be spent on include:

- Federally – there is $305 M Canada is providing for Indigenous community supports

- $215M – FN communities and formulas for this will be created by each Region (i.e. BC ISC Region). There is no word yet on how BC Region will be formulating how this money will go to FN in BC.

- $15M Urban organizations (i.e. Friendship Centre etc)

- $45M Inuit

- Allocation in two streams have already gone out to FN. In BC this is $7.2 Million for Emergency Mgt and $2.7 Million for Social Programs. Amendments have already gone out to all BC First Nations last week. Electronic signatures are accepted so that the process can be expedited so that Councils are not required to have in person meetings for the amendment(s).

- Summary List of Resources for First Nations

- ISC is working on this now along with BCAFN and First Nations Public Service Secretariat and others

- ISC / FNHA / EMBC have set up a ‘window’ approach so that when requests come in, they share the request with each other and collaborate on how best to respond to FN requests. This will also be on FNPSS website.

- ISC has a dedicated Covid-19 email set up – this is on their website. They have a 48 Hour response time for any questions sent in

- ISC is working on this now along with BCAFN and First Nations Public Service Secretariat and others

- Templates/Plans for Band Offices and Covid-19 – nothing seems to be available yet

The government has set aside a different pot for people living off reserve and non-native people and that is the $2,000.00 per month.

BC Hydro:

“We recognize the financial impact COVID-19 may have on our customers due to changes in employment from workplaces closing, or reducing staffing levels and want to provide some relief during this challenging time,” said Chris O’Riley, BC Hydro President and Chief Executive Officer. “In addition, some customers may experience higher electricity bills due to increased consumption from spending more time at home.”

The COVID-19 Customer Assistance Program provides customers the option to defer bill payments or arrange for flexible payment plans with no penalty. Customers are encouraged to call BC Hydro’s customer team at 1 800 BCHYDRO (1 800 224 9376) to discuss bill payment options.

Customers facing temporary financial hardship and possible disconnection of their service due to job loss, illness, or loss of a family member may also be eligible for BC Hydro’s Customer Crisis Fund, which provides access to grants of up to $600 to pay their bills.

RENT:

To support people and prevent the spread of COVID-19, the Province is introducing a new temporary rental supplement, halting evictions and freezing rents, among other actions.

The new rental supplement will help households by offering up to $500 a month towards their rent, building on federal and provincial financial supports already announced for British Columbians facing financial hardship.

The Province is implementing a number of additional measures to keep people housed and protect their health. The full list of immediate measures includes:

- The new temporary rent supplement will provide up to $500 per month, paid directly to landlords.

- Halting evictions by ensuring a landlord may not issue a new notice to end tenancy for any reason. However, in exceptional cases where it may be needed to protect health and safety or to prevent undue damage to the property, landlords will be able to apply to the Residential Tenancy Branch for a hearing.

- Halting the enforcement of existing eviction orders issued by the Residential Tenancy Branch, except in extreme cases where there are safety concerns. The smaller number of court ordered evictions are up to the courts, which operate independently of government.

- Freezing new annual rent increases during the state of emergency.

- Preventing landlords from accessing rental units without the consent of the tenant (for example, for showings or routine maintenance), except in exceptional cases where it is needed to protect health and safety or to prevent undue damage to the unit.

- Restricting methods that renters and landlords can use to serve notices to reduce the potential transmission of COVID-19 (no personal service and allowing email).

- Allowing landlords to restrict the use of common areas by tenants or guests to protect against the transmission of COVID-19.

Learn More:

For information on B.C.’s COVID-19 Action Plan and other government resources and updates, visit: www.gov.bc.ca/covid19

CERB:

March 25, 2020 – Ottawa, Ontario – Department of Finance Canada

The Government of Canada continues to take action to help Canadians and businesses facing hardship as a result of the COVID-19 outbreak. Learn more about the latest measures at Canada’s COVID-19 Economic Response Plan.

The Government of Canada is taking strong, immediate and effective action to protect Canadians and the economy from the impacts of the global COVID-19 pandemic. No Canadian should have to choose between protecting their health, putting food on the table, paying for their medication or caring for a family member.

To support workers and help businesses keep their employees, the government has proposed legislation to establish the Canada Emergency Response Benefit (CERB). This taxable benefit would provide $2,000 a month for up to four months for workers who lose their income as a result of the COVID-19 pandemic. The CERB would be a simpler and more accessible combination of the previously announced Emergency Care Benefit and Emergency Support Benefit.

The CERB would cover Canadians who have lost their job, are sick, quarantined, or taking care of someone who is sick with COVID-19, as well as working parents who must stay home without pay to care for children who are sick or at home because of school and daycare closures. The CERB would apply to wage earners, as well as contract workers and self-employed individuals who would not otherwise be eligible for Employment Insurance (EI).

Canadians who are already receiving EI regular and sickness benefits as of today would continue to receive their benefits and should not apply to the CERB. If their EI benefits end before October 3, 2020, they could apply for the CERB once their EI benefits cease, if they are unable to return to work due to COVID-19. Canadians who have already applied for EI and whose application has not yet been processed would not need to reapply. Canadians who are eligible for EI regular and sickness benefits would still be able to access their normal EI benefits, if still unemployed, after the 16-week period covered by the CERB.

The government is working to get money into the pockets of Canadians as quickly as possible. The portal for accessing the CERB would be available in early April. EI eligible Canadians who have lost their job can continue to apply for EI here, as can Canadians applying for other EI benefits.

Canadians would begin to receive their CERB payments within 10 days of application. The CERB would be paid every four weeks and be available from March 15, 2020 until October 3, 2020.

This benefit would be one part of the government’s COVID-19 Economic Response Plan, to support Canadian workers and businesses and help stabilize the economy by helping Canadians pay for essentials like housing and groceries, and helping businesses pay their employees and bills during this unprecedented time of global uncertainty.

GST:

We are providing a one-time special payment starting April 9 through the Goods and Services Tax credit for low- and modest-income families.

The average additional benefit will be close to $400 for single individuals and close to $600 for couples.

There is no need to apply for this payment. If you are eligible, you will get it automatically.